Direct Material Cost vs. Direct Material Price

- Douglas T. Hicks CPA

- Jul 15, 2022

- 3 min read

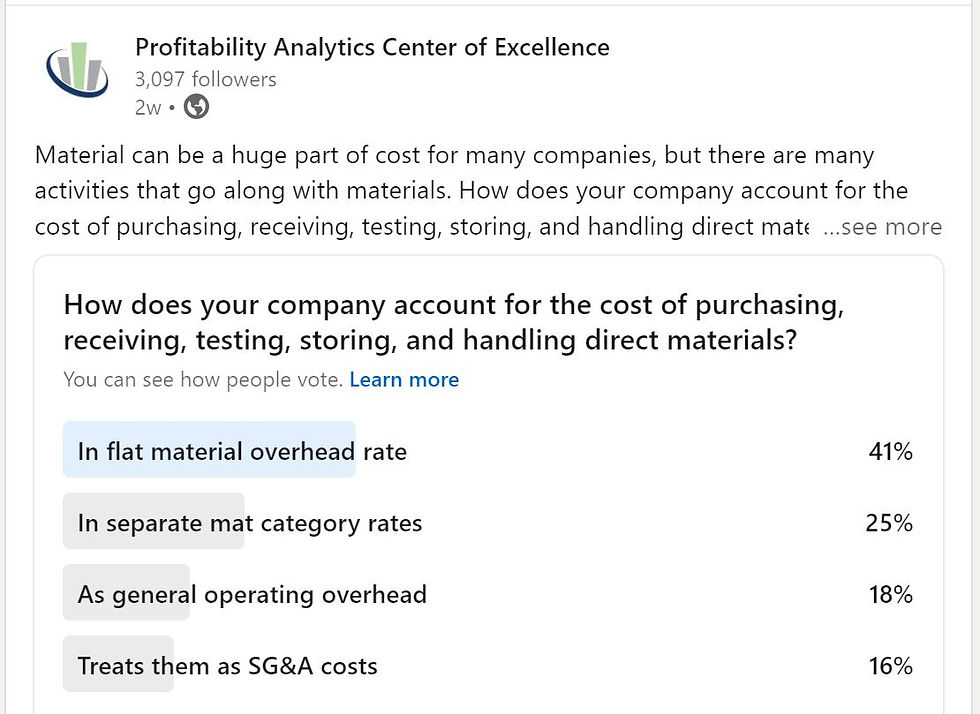

The results of PACE’s recent poll asking how organization’s handle the costs of purchasing, receiving, testing, storing, and handling direct materials provided us with some good news and some bad news. The good news is that nearly two-thirds of the participants link those costs with the materials being purchased and do not bury them in overhead or SG&A costs. The bad news is that only one-fourth of the participants appear to take the subject seriously.

The cost of direct material (which includes components, sub-assemblies, outside manufacturing services, etc.) is the total cost required to have the material (or service) where it needs to be and when it needs to be there to enter the organization’s stream of value-adding activities. For a roll of steel, that’s when it arrives at the decoiler. For a component, it’s when it arrives at the assembly station. For resins, it’s when they arrive at the molding machine. This means it not only includes the price paid for the material (or service), but the cost of all the activities required for it to be available where and when needed.

Attributing the cost of activities like purchasing, receiving, testing, storing, and handling to direct materials instead of overhead or SG&A is a step in the right direction. It assigns them to the right category of “stuff.” But assigning them as a flat rate to every category of direct material can still lead to significant distortions in material cost.

Consider an injection molder that purchases a few of its resins in very high volumes and the other resins in relatively low volumes. The high-volume resins are purchased under a blanket order negotiated annually and are delivered twice per month to a silo behind the facility from where they are delivered to the molding machine by an automated system as required. Usage is measured by the automated system. They are sampled on a test basis and are invoiced by the vendor once per month. The low-volume resins are purchased as needed, arrive in containers known as “gaylords,” tested upon receipt, and then stored until needed. When the resins are needed the gaylords are moved to the molding machine, the resin manually loaded into the machine, usage measured by the operator, and the unused material returned to storage. Each delivery is invoiced individually. In every case I’ve encountered, the support cost per pound of the high-volume resins has been significantly less than that of the low-volume resins. A flat rate per pound or percentage of resin cost would not accurately measure the impact volume has on the total cost of the resin.

Volume is not the only factor than can impact the level of support required by various direct materials. Does the inventory of materials being purchased turn quickly or slowly? Are they easy to source or hard to source? Are they off-the-shelf or custom? Are they vendor-managed or company-managed? Are they purchased domestically or from offshore? Do the outside manufacturing services occur pre-production, mid-production, or post-production? And what about customer provided (or consigned) materials? They have no price, but they certainly have a cost. These are just some of the characteristics that can result in different support costs for different materials.

The complexities of today’s supply chains make the domestic vs. offshore issues especially critical. A few years back I picked up a new auto industry client who had “saved” $3 million annually by purchasing some of its component parts offshore. It only required a cursory review of its operations to find the $3.5 million they were spending to save the $3 million. And that didn’t include the less tangible costs. Not paying attention to the total cost of direct materials, only the price, cost them dearly.

Causality-based operating and cost models, like those advocated by the Profitability Analytics Framework, will highlight the different costs required to support the various categories of direct materials and services purchased by an organization and lead them to make more economically sound pricing and sourcing decisions.

Comments