Cost vs. Revenue: Effective Profitability Analysis Requires You Consider Both!

- Larry White

- Jun 22, 2022

- 2 min read

I was at a conference very recently, in a session on cost management, and the question came up: “How can we rationalize or control the number of SKU’s we have?” This began a discussion of the many cost management issues a large number of SKU’s (or product variations) can generate.

This was a very good “cost management” discussion that was completely missing the most important question. How much revenue and profit did each of the SKU’s generate? And which customers or customer segments were being served? And were those customers or customer segments profitable?

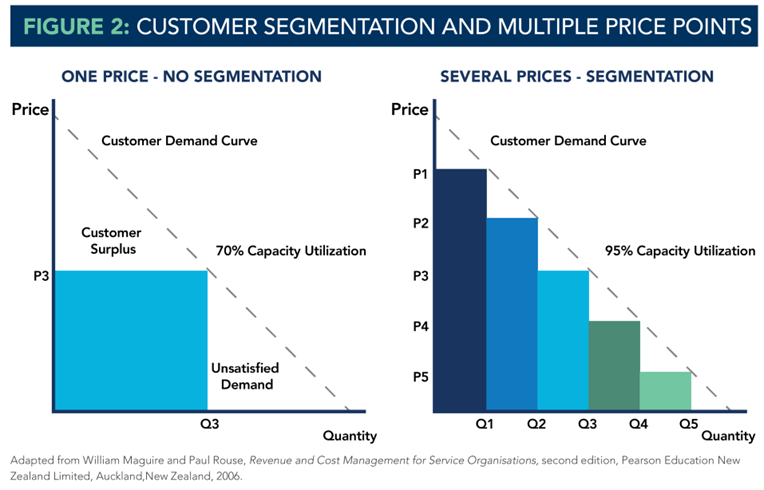

One of my favorite diagrams showing the value of multiple products or services is from the Institute of Management Accountants SMA Revenue Management Fundamentals. It shows the changes that may be required to capture the demand of your customer segments, and the benefit of doing so.

I’m sure when the cost focused accountants brought forward a recommendation to reduce SKU’s, sales and marketing would have provided them the relevant revenue and customer information. The real question is: would our cost focused accountants have ventured into the realm of revenue and customer profitability before bringing forward a “cost reduction” recommendation? I hope so, but I wonder.

Then you must wonder if either, accountants or sales/marketing, would consider (or have the information to consider) all the causal costs and potential revenue opportunities associated with the SKU’s/products and characterize them correctly to assess the incremental and marginal profitability.

Neither revenue or cost tells a full story by themselves, no matter how comprehensive the information. Profitability and knowledge of your customers is the key to effective business recommendations. This understanding and perspective is what it takes to be a business partner. The Profitability Analytics Framework is a great tool to ensure you look at all aspects of business decision – Revenue, Operations & Cost, and Investment – and that you look with the proper perspective and timeframe – Strategically and/or Execution.

Comments